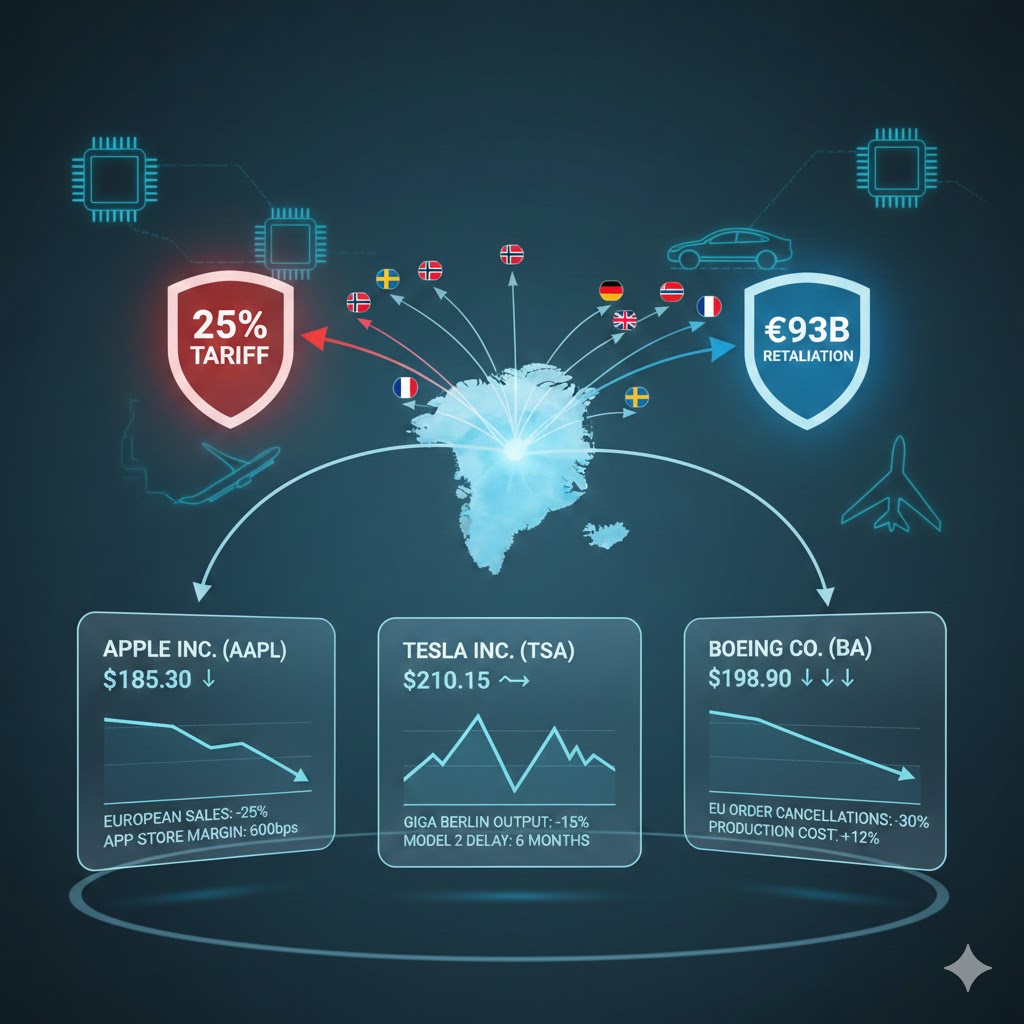

The geopolitical landscape was set ablaze on January 17, 2026, when President Donald Trump utilized his social media platform to issue a seismic trade ultimatum that has sent shockwaves through global markets. Invoking the “Safety, Security, and Survival of our Planet,” the President announced a 10% tariff on all goods imported from eight European nations—Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland—beginning February 1, 2026. This rate is scheduled to skyrocket to 25% by June 1, 2026, unless a deal is reached for the “complete and total purchase of Greenland.”

The rationale provided by the White House centers on the sudden “unknown” military maneuvers of these eight nations within the Danish autonomous territory. Trump’s post highlighted a 150-year-old American ambition to acquire the island, now escalated by the strategic necessity of the “Golden Dome” missile defense system. In immediate response, the European Union has signaled its intent to retaliate by targeting €93 billion ($101 billion) of U.S. goods and restricting American corporate access to the Single Market.

As the “Greenland Gambit” unfolds, the financial implications for U.S. equities are profound. By analyzing revenue exposure, supply chain vulnerabilities, and the specific retaliatory targets of the EU, three stocks emerge as the most exposed to this transatlantic trade war: Apple Inc. (AAPL), Tesla Inc. (TSLA), and The Boeing Company (BA).

Apple Inc. (AAPL): A Two-Front War on Margins and Market Access

[AAPL] stock faces a uniquely precarious situation. While Apple is often viewed through the lens of its Chinese manufacturing base, its European operations are the silent engine of its high-margin services and hardware growth. In fiscal year 2025, Europe accounted for approximately 25% of Apple’s total net sales, reaching nearly $100 billion. The EU’s threat to “restrict American companies from the bloc’s market” strikes directly at Apple’s most lucrative expansion area: the Digital Markets Act (DMA) compliant App Store and its burgeoning AI services.

The Apple (AAPL) stock price has historically been sensitive to trade disruptions, but the Greenland tariffs introduce a “circular” cost pressure. Apple imports a significant array of high-end components and specialized machinery from Germany and the Netherlands (specifically from lithography giant ASML partners) for its domestic R&D and limited U.S.-based assembly. A 25% tariff on these precision tools would inflate the capital expenditure required for Apple’s “Apple Silicon” development.

Financially, Apple’s balance sheet remains robust, with over $160 billion in cash and marketable securities as of their most recent quarterly filing. However, the 2026 guidance already factored in a 5% growth in European hardware sales driven by the “iPhone 17” cycle and the rollout of Apple Intelligence in local languages. If the EU retaliates with a 25% “digital sovereignty tax” or targeted luxury tariffs—a tactic used in previous trade disputes—Apple’s operating margins in the region, which currently hover around 38%, could contract by 400 to 600 basis points.

Furthermore, the “Greenland mission” cited by Trump involves nations that are home to Apple’s primary European data centers (Denmark and Sweden). Regulatory friction or “national security” audits by these governments in response to U.S. pressure could delay the deployment of Apple’s new “Private Cloud Compute” infrastructure. For investors monitoring AAPL stock, the primary risk is not just the cost of goods, but the potential for a “regulatory blockade” that halts the monetization of AI across the European continent.

Tesla Inc. (TSLA): The Giga Berlin Bottleneck and Retaliatory Targets

No company is more physically entrenched in the crosshairs of this dispute than Tesla. With Giga Berlin-Brandenburg serving as its primary European manufacturing hub, Tesla (TSLA) stock is exposed to both the U.S. import tariffs and the EU’s retaliatory list, which specifically mentions “vehicles” as a primary target for the €93 billion counter-strike.

According to Tesla’s 2025 annual report, the company has successfully ramped production at Giga Berlin to an annual run rate of 600,000 vehicles. However, the facility remains heavily dependent on specialized parts and power electronics imported from the United States, as well as the export of specialized Model Y variants back to the North American market to satisfy specific trim demands. The proposed 25% U.S. tariff on German-made goods would effectively end the viability of importing European-made Teslas into the U.S., while the EU’s retaliatory tariffs would hit Tesla’s U.S.-made Model S and Model X exports to Europe.

The Tesla (TSLA) stock price recently saw volatility following the announcement, as investors digested the impact on the “Model 2” (the $25,000 next-generation vehicle) development timeline. Tesla had planned for a simultaneous global rollout in 2026, with Giga Berlin playing a lead role in the European market entry. If trade barriers rise, Tesla may be forced to bifurcate its supply chain, a “de-globalization” move that would significantly increase the unit cost of its most important upcoming product.

From a market expansion perspective, Tesla’s “FSD (Full Self-Driving) 12” European pilot program, which was slated for a wide release in late 2026, could become a political pawn. The EU has indicated it may use its “anti-coercion instrument” to block the certification of U.S. autonomous driving software. Given that Tesla’s long-term valuation—often cited by bulls as being driven by AI and Robotaxis—is predicated on global software-as-a-service (SaaS) revenue, a lockout from the European market would be a devastating blow to the growth narrative of TSLA stock.

The Boeing Company (BA): The Aerospace “Trench War” with Airbus

Perhaps the most direct casualty of a Greenland-related trade war is The Boeing Company (BA). The EU’s retaliation list of €93 billion explicitly targets “aircraft,” a move designed to provide a competitive windfall for Boeing’s arch-rival, the European-consortium Airbus. For Boeing (BA) stock, which is currently in the midst of a fragile recovery following years of production setbacks and safety scrutinies, a trade war is the ultimate “black swan” event.

Boeing’s 2026-2027 backlog includes hundreds of orders from European carriers like Lufthansa (Germany), Air France-KLM (France), and Ryanair (Ireland). These airlines, many of which receive state support or operate within the high-regulation environment of the EU, would face immense political and financial pressure to cancel Boeing orders in favor of Airbus if a 25% retaliatory tariff is applied to U.S.-made aircraft.

Analysis of BA stock must account for the company’s “2026 Turnaround Plan,” which relies on increasing 737 MAX production to 50 per month and stabilizing the 787 Dreamliner line. European suppliers provide critical components for these airframes—for instance, French-based Safran provides the LEAP-1B engines for the 737 MAX. If Trump’s 25% tariff makes these engines prohibitively expensive to import into the U.S., Boeing’s production costs will spiral, potentially forcing the company to seek further debt financing or government subsidies, further diluting the Boeing (BA) stock price.

Moreover, the “Golden Dome” defense system mentioned by Trump suggests an escalation in military spending. While Boeing is a major defense contractor, the potential for being “blacklisted” from European defense procurement—such as future fighter jet competitions or refueling tanker contracts in the UK and Germany—could offset any gains from increased U.S. domestic defense spending. For those tracking BA stock, the threat of a “closed” European aerospace market represents a long-term structural risk that far outweighs short-term geopolitical posturing.

Conclusion: Navigating a New Era of “Arctic Real Estate” Economics

The confrontation over Greenland marks a departure from traditional trade disputes. By linking sovereign territory acquisition to commercial tariffs, the U.S. administration has introduced a level of unpredictability that markets are struggling to price. The €93 billion retaliation from Europe is not merely a threat; it is a calculated strike at the heart of the U.S. tech and industrial sectors.

For Apple, the risk lies in the “digital curtain” falling across Europe. For Tesla, it is the fragmentation of a once-unified global manufacturing strategy. For Boeing, it is the potential loss of the world’s second-largest aviation market to a domestic competitor. As February 1 approaches, the AAPL stock, TSLA stock, and BA stock tickers will serve as the primary thermometers for this freezing of transatlantic relations.