A research report sent to clients by Wall Street financial giant JPMorgan (NYSE:JPM) on Tuesday revealed that hedge funds, often referred to as “smart money,” bought up the largest U.S. tech giants and SaaS software stocks that are thought to be highly susceptible to cutting-edge AI technologies. This could indicate that the Nasdaq 100 Index (NASDAQ:NDX), which is considered a “barometer” for tech stocks, might be poised for a short-term rebound after nearly a month of pullbacks.

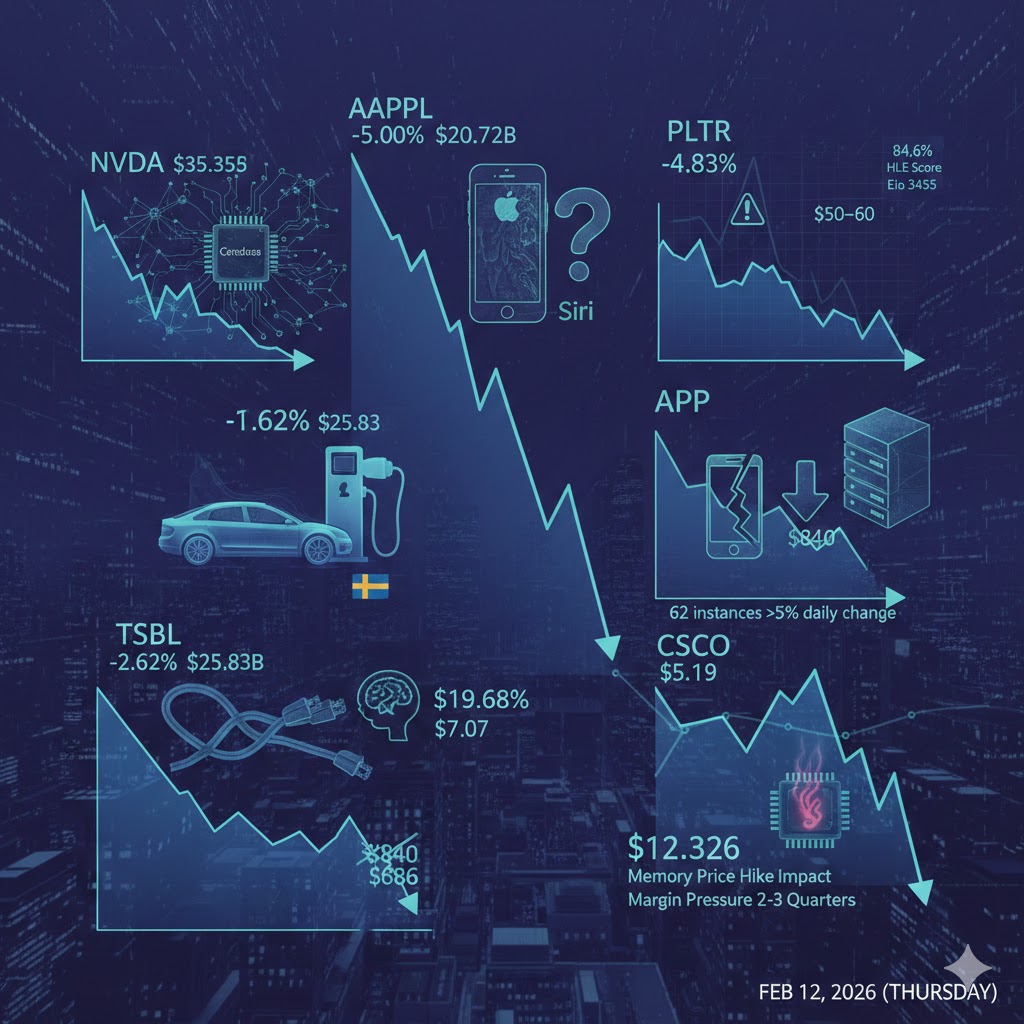

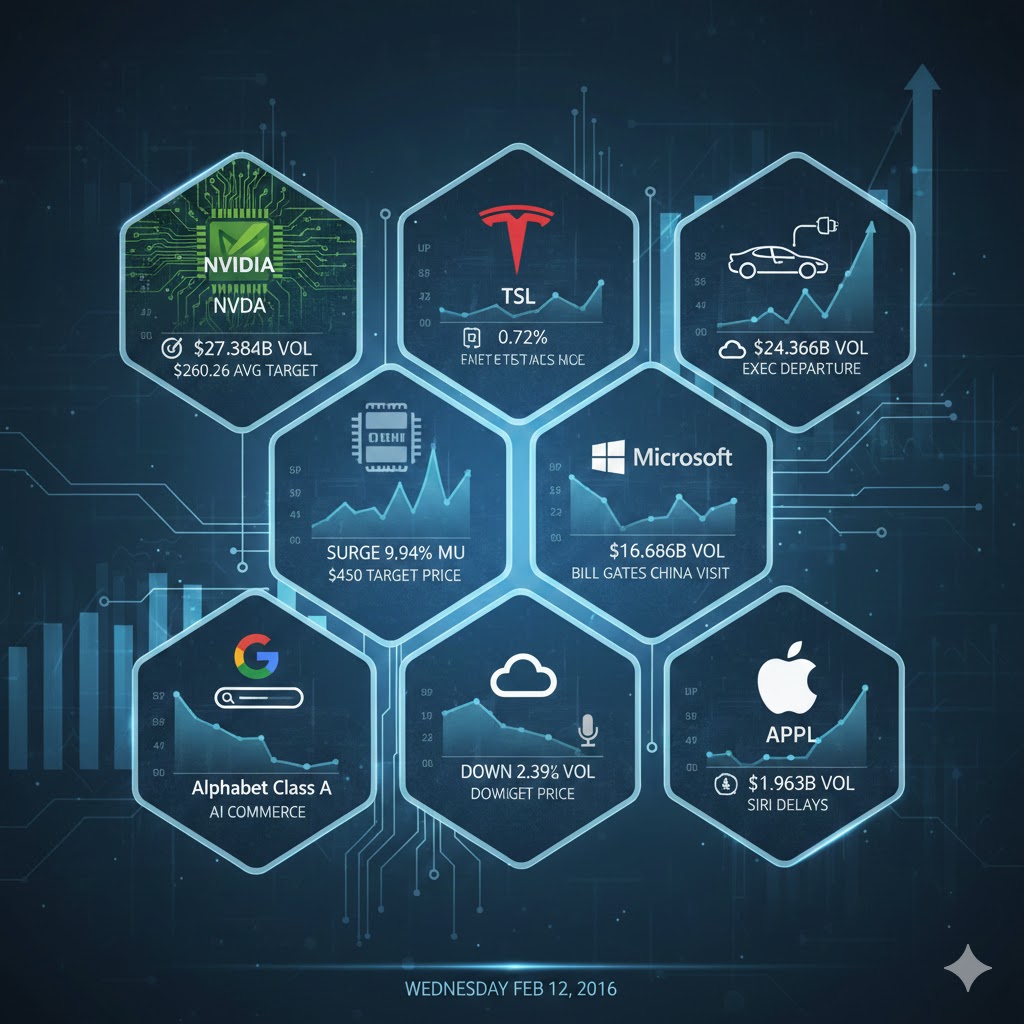

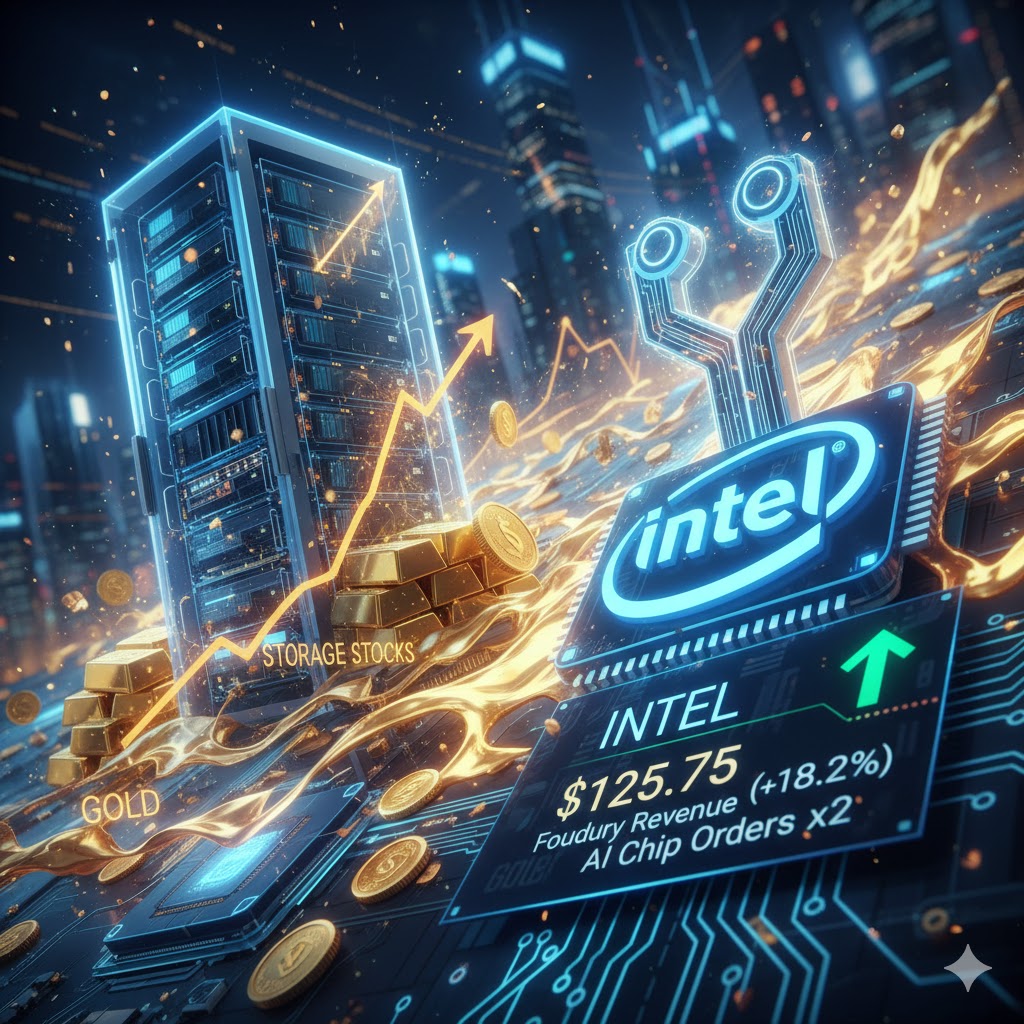

Following the substantial rally of the U.S. stock market’s super bull run since 2023, the world’s seven largest U.S. tech giants, including Google (NASDAQ:GOOGL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), and Nvidia (NASDAQ:NVDA), have seen significant declines in their stock prices this year. This downturn is primarily due to investors beginning to question whether the massive and ongoing investments in AI infrastructure (with the four largest U.S. tech giants expected to spend over $700 billion on AI in 2026, a 60% increase) can generate sufficient returns to justify their high valuations.

The so-called “Mag 7,” comprising Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Google (NASDAQ:GOOG), Tesla (NASDAQ:TSLA), Nvidia (NASDAQ:NVDA), Amazon (NASDAQ:AMZN), and Meta Platforms (NASDAQ:META), collectively make up around 35%-40% of the weight in both the S&P 500 Index (NASDAQ:SPX) and the Nasdaq 100 Index (NASDAQ:NDX). They have been the driving force behind the continuous highs in the S&P 500 and are seen by Wall Street’s top investors as the most capable group of companies to deliver substantial returns amid the biggest technological transformation since the internet era.

“Despite the extreme divergence in hedge fund positions between semiconductors and software stocks globally, in the U.S. and Europe, this rotation appears to have slowed down or even reversed slightly,” JPMorgan’s report states.

The bank noted that after a record-scale selloff the previous week, software stocks in the U.S. have seen a net inflow, though no specific time frame for this was provided.

Another Wall Street financial giant, Goldman Sachs (NYSE:GS), recently released a client investment memo showing that hedge funds’ leverage levels have increased since the week of February 14, approaching the highest level in a year. At the same time, hedge funds focusing on leverage strategies have seen their leverage levels rise, often signaling that if macroeconomic, tariff, or geopolitical “noise” resurges, the pullback could be sharper.

The client memo stated that global stock markets, as of the week ending February 19, had seen the highest net selling scale since former U.S. President Donald Trump announced a series of import tariffs in April of the previous year.

Goldman Sachs noted that what surprised investors was that the financial sector in the U.S. market saw the highest net selling, while long-time defensive sectors like energy, healthcare, and consumer staples saw the largest net buying. However, the firm did not break down the financial sector into subcategories.

After several weeks of de-leveraging and sell-offs, hedge funds have begun showing signs of “marginal buying.” They have started to re-enter large-cap tech giants and software stocks that were previously battered by the AI narrative. JPMorgan itself emphasized that the gap between semiconductor and software positions remains “extreme/stretched,” but the rotation “seems to have slowed down or reversed slightly.” This type of “overcrowded trade, forced de-leveraging, and eventual marginal buying flow” structure is more likely to trigger a technical rebound (especially driven by short-covering, position rebalancing, and mean reversion).

The sharp decline in software stocks is mainly due to market concerns that AI agent workflows, like those seen with Claude and OpenClaw (formerly Clawdbot and Moltbot), which have gone viral, could undermine the entire software empire built on SaaS subscription revenue models. This led to a rare sell-off that quickly spread to industries like insurance, real estate, trucking, and other labor-intensive business models. The market views these sectors as likely to be completely disrupted by AI, leading to a significant decline in profits. This shift highlights that investors are rotating out of North American SaaS software stocks and high-expenditure North American AI pioneers like Microsoft and Amazon, instead favoring AI computing infrastructure producers with stronger pricing power.

However, most analysts indicate that it’s still too early to say that “the tech giants + software stocks are about to reverse trends,” mainly because the underlying causes of the sell-off (uncertainty over the return on massive AI investments, valuation digestion, and concerns over SaaS business models being eaten away by AI) have not been resolved. Additionally, the recent decline in software stocks itself carries characteristics of “narrative shock + risk aversion contraction.” In other words, a more reasonable assessment is that, driven by hedge funds, a short-term oversold rebound window has opened, but it is more likely to be a “short-term tactical repair rebound” rather than the start of a new one-sided bull market.