A 16% rise in one year—this is the gain recorded by the S&P 500 Index (.SPX) during Donald Trump’s first year back in the Oval Office.

However, behind this seemingly stellar figure lies a “rollercoaster” journey for Wall Street, characterized by sharp corrections intertwined with historic highs. This past year has proven one thing to investors: even in the face of sweeping policy shifts, the market possesses a powerful ability to digest change. But as we enter a volatile 2026, the market’s resilience will face even sterner tests.

As the “Trump 2.0” era enters a Midterm Election year, what should investors watch for? Which sectors are poised to benefit? This article provides an in-depth breakdown.

A Bull Market Amidst Turmoil: The Quality of the 16% Gain

Since Donald Trump was sworn in as the 47th President of the United States on January 20, 2025, the U.S. stock market has demonstrated remarkable pressure resistance. Although Trump announced his “Liberation Day” tariff policies on April 2, triggering market tremors, investors were quick to adopt a “buy the dip” strategy. This pattern, dubbed “The TACO Trade” by some market participants, reflects a new consensus: the administration’s aggressive policy proclamations may not necessarily translate into lasting market damage.

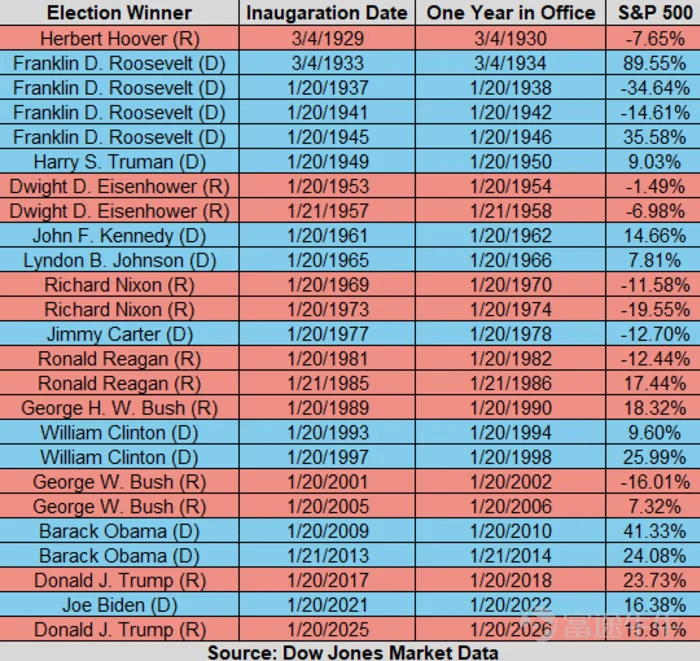

From a historical perspective, a 16% gain is impressive, outperforming the historical median of 9% for a president’s first year since 1929. However, it is not the “strongest in history.” In comparison, the S&P 500 rose 16.4% during President Biden’s first year, while Trump’s own first term in 2017 saw a surge of 23.7%.

For those who originally expected Trump’s second term to be “extremely bullish” for the markets, this year has been full of challenges.

Chris Maxey, Managing Director and Chief Market Strategist at Wealthspire Advisors, described it this way: “The first year of Trump’s return has seen news coming at us like water from a firehose.” He noted that the most important lesson investors have learned over the past year is to “stay patient.” Overinterpreting political headlines often leads to portfolio errors rather than gains.

There were widespread fears that Trump’s volatile tariff policies would ignite a global trade war, reignite inflation, or push the economy into recession. To date, these worst-case scenarios have not materialized. While some tariff policies still await a final ruling from the Supreme Court, the S&P 500 has set 42 record closing highs since last January, while the Dow Jones and Nasdaq have refreshed their records 23 and 36 times, respectively.

2026 Outlook: The Shadows of Midterm Elections and Geopolitics

As the calendar turns to 2026, investors may find it difficult to maintain their high levels of optimism. The market is entering a “Midterm Election Year,” which is traditionally the weakest performing year of a presidential term. Historical data shows that since 1948, the S&P 500 has averaged a gain of only 4.6% in the second year of a presidency.

Adding to the concern, the start of 2026 has been anything but peaceful. In the first half of January alone, the market faced a series of geopolitical and policy shocks:

- Venezuela Turmoil: U.S. military action led to the arrest of Venezuelan leader Nicolás Maduro.

- Greenland Controversy: Trump reiterated threats to take over or purchase Greenland.

- U.S.-Iran Tensions: Relations between the two nations have tightened once again.

- Federal Reserve Crisis: A criminal investigation targeting current Fed Chair Jerome Powell has raised serious concerns regarding central bank independence.

Particularly noteworthy are Trump’s actions last week, which dominated investment circles—specifically regarding tariff policies and the selection of the next Fed Chair.

- Tariff Policies: According to CCTV reports, on Saturday (Jan 17), President Trump announced that effective February 1, 2026, a 10% tariff will be imposed on all goods exported to the U.S. from Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland. Effective June 1, 2026, this rate will increase to 25%. The stated reason for these tariffs is the opposition of these nations to U.S. control of Greenland, further escalating the dispute over the island’s future.

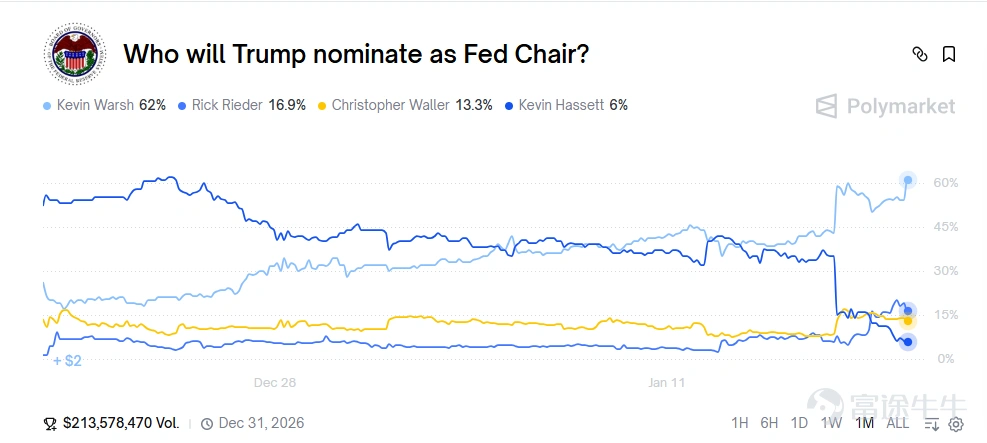

- Fed Chair Uncertainty: Trump hinted last Friday that Kevin Hassett might not become the new Fed Chair, following Hassett’s repeated calls for the Fed to cut interest rates aggressively. As Hassett likely remains Director of the National Economic Council (NEC), the race has essentially narrowed to a “three-way battle”: BlackRock’s Rick Rieder vs. former Fed Governor Kevin Warsh and current Governor Christopher Waller. The latter two possess extensive central banking experience and represent more traditional choices compared to Rieder’s market-oriented background.

Soochow Securities suggests that in 2026, Trump will exhaust all available political resources—including trade policy under White House authority, fiscal policy under Congressional power, and monetary policy via the Fed—to prepare for the final “exam” of his political career: the Midterm Elections.

Trump’s strategy for the midterms consists of three complementary pillars that form the primary trading theme for 2026:

- Trade Policy: Trump may escalate tariff conflicts to divert domestic tension, gain votes, pressure the Fed to cut rates, and generate fiscal revenue.

- Monetary Policy: A new Fed Chair is expected to take office in May 2026. Markets anticipate “oversized” rate cuts that exceed economic necessity. This “Fed Put” is expected to replace “TACO” as a hedge against tariff shocks, with loose monetary policy boosting the economy and stocks.

- Fiscal Policy: Rate cuts and tariffs will provide funding for fiscal expansion. In the second half of 2026, Trump is expected to introduce broad fiscal policies to build momentum for the midterms.

For capital markets, these three policies will weave a combination of recurring tariffs and “double easing” (fiscal and monetary). This may shift the U.S. economy from a soft landing back into expansion, but it also carries significant upside risks for inflation in late 2026 and beyond.

Market Implications:

- Tariff Volatility: Risk appetite will likely follow a mean-reversion, “sell high, buy low” strategy.

- Double Easing: Global equities, commodities, and other risk assets will benefit from the dual tailwinds of liquidity and fundamentals on an annual basis.

- Fed Leadership Change: Excessive rate cuts may lead to lower U.S. interest rates and weakened credit, favoring Gold while putting downward pressure on the US Dollar Index and 2-year Treasury yields. Combined with fiscal expansion, the 10-year Treasury yield is expected to remain volatile.

Which Opportunities Deserve Close Attention in the Trump Era?

Since taking office, Trump’s every word and action has deeply influenced the U.S. market. Insight into and alignment with government investment logic is not just about capturing opportunities—it is a necessary strategy for risk mitigation.

Market consensus suggests that the following four sectors—Resources, Power/Energy, Space Exploration, and Semiconductors—are most likely to benefit from the “Trump 2.0” era.

Specific Companies to Watch:

- Semiconductors: Nvidia (NVDA), Broadcom (AVGO), AMD (AMD), Micron (MU).

- Rare Earths: MP Materials (MP), TMC the metals (TMC), USA Rare Earth (USAR), Critical Metals (CRML).

- Lithium: Rio Tinto (RIO), SQM (SQM), Albemarle (ALB), Lithium Americas (LAC).

- Uranium: Cameco (CCJ), Uranium Energy (UEC), Centrus Energy (LEU), Energy Fuels (UUUU).

- Copper: Southern Copper (SCCO), Freeport-McMoRan (FCX).

- Graphite: NOVONIX (NVX), Nouveau Monde Graphite (NMG), Westwater Resources (WWR).

- Antimony/Beryllium: Nova Minerals (NVA), United States Antimony (UAMY), Materion (MTRN).

- Space Exploration: Rocket Lab (RKLB), AST SpaceMobile (ASTS), EchoStar (SATS.US), GE Aerospace (GE), RTX Corp (RTX), Boeing (BA), Lockheed Martin (LMT).

- Nuclear Power: Oklo Inc (OKLO), BWX Technologies (BWXT), NuScale Power (SMR), NANO Nuclear Energy (NNE).

- Batteries/Storage: Tesla (TSLA), Bloom Energy (BE), QuantumScape (QS), Eos Energy (EOSE).

- Grid & Storage: GE Vernova (GEV), Vistra Energy (VST.), AES Corp (AES), Fluence Energy (FLNC).

Additionally, Morgan Stanley released a “National Security Index” focusing on four key areas: Rare Earths & Strategic Metals, Batteries & Energy Storage, Lithium, and Nuclear & Uranium. These companies are the core drivers of the currently trending “Trump Trade.”