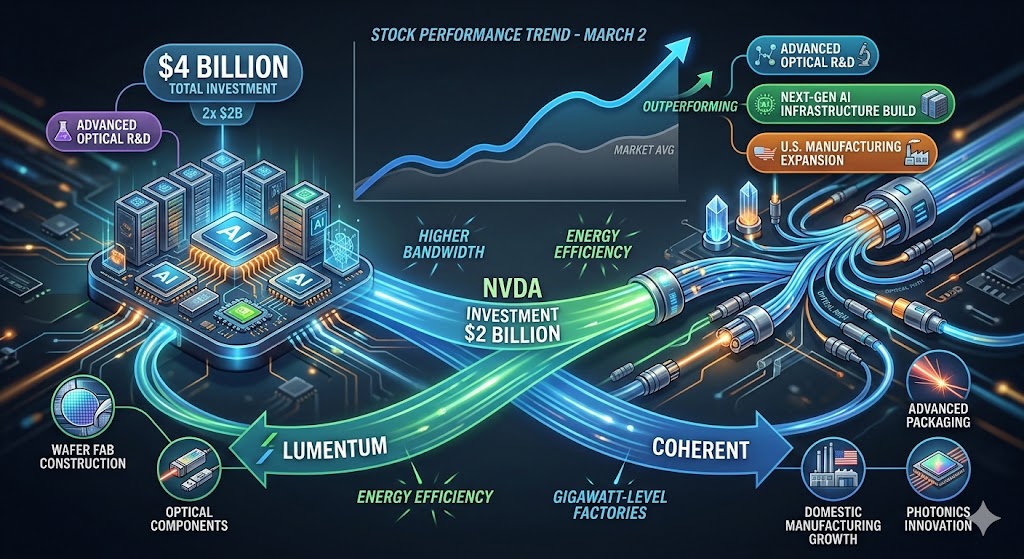

On March 2, U.S. stocks in the optical communication sector rose against the market trend. NVIDIA announced strategic multi-year partnerships with two leading companies in the optical communications field, Lumentum and Coherent, investing $2 billion in each, for a total of $4 billion. This investment will focus on the research and development of advanced optical technologies and manufacturing, accelerating the large-scale development of the next-generation AI infrastructure. It further strengthens NVIDIA’s global leadership in AI and accelerated computing.

The partnerships are non-exclusive agreements, each including billions of dollars in product procurement commitments, as well as capacity usage and priority rights for future advanced lasers, optical networks, products, and components.

NVIDIA’s investment will primarily support the research and development work of Lumentum and Coherent, future capacity expansion, and daily operations, while also helping the companies increase their U.S. domestic manufacturing capabilities. Lumentum will build a new wafer fab, and Coherent will expand its domestic manufacturing presence.

Optical interconnect technology and advanced packaging integration are the key foundations for continuously expanding AI computing factories and achieving ultra-high bandwidth and energy-efficient interconnectivity. These are critical components of the next-generation AI infrastructure. Through this cooperation, NVIDIA aims to leverage its technological and market advantages in AI, accelerated computing, and networking, while combining Lumentum’s strengths in optical and photonics technology and Coherent’s expertise in optical innovation and advanced manufacturing. The goal is to push breakthroughs in cutting-edge fields such as silicon photonics technology and support both partners in increasing their capacity and research investments to meet the construction needs of global next-generation AI data centers.

Jensen Huang, founder and CEO of NVIDIA, stated, “Artificial intelligence is reshaping computing models and driving the largest-scale infrastructure buildout in history. This partnership with two leading companies will help NVIDIA develop more advanced silicon photonics technology and accelerate AI infrastructure breakthroughs in scale, speed, and energy efficiency to create gigawatt-level next-generation AI computing factories.”

Jim Anderson, CEO of Coherent, commented, “This strategic partnership reaffirms Coherent’s critical role as a core enabler of next-generation artificial intelligence data center infrastructure. We are honored to deepen this 20-year-long partnership with NVIDIA, providing support for a wide range of products to help them build future AI data centers.”

Michael Helston, CEO of Lumentum, said, “This multi-year strategic agreement demonstrates our mutual commitment to advancing optical technology innovations that will become the driving force of next-generation AI infrastructure. To support this collaboration, we will invest in building a new manufacturing plant to increase capacity and accelerate technological innovation. We look forward to working with NVIDIA to continuously break through technical boundaries and unlock more possibilities for future AI optical architectures.”

Lumentum is a global leader in optical and photonics technology, providing core support for AI and cloud computing network infrastructure. It is headquartered in San Jose, California. Coherent, founded in 1971, is a leader in photonics, with operations in over 20 countries, providing world-leading photonics technology for data centers and communications.