The top stocks to sell by trading volume:

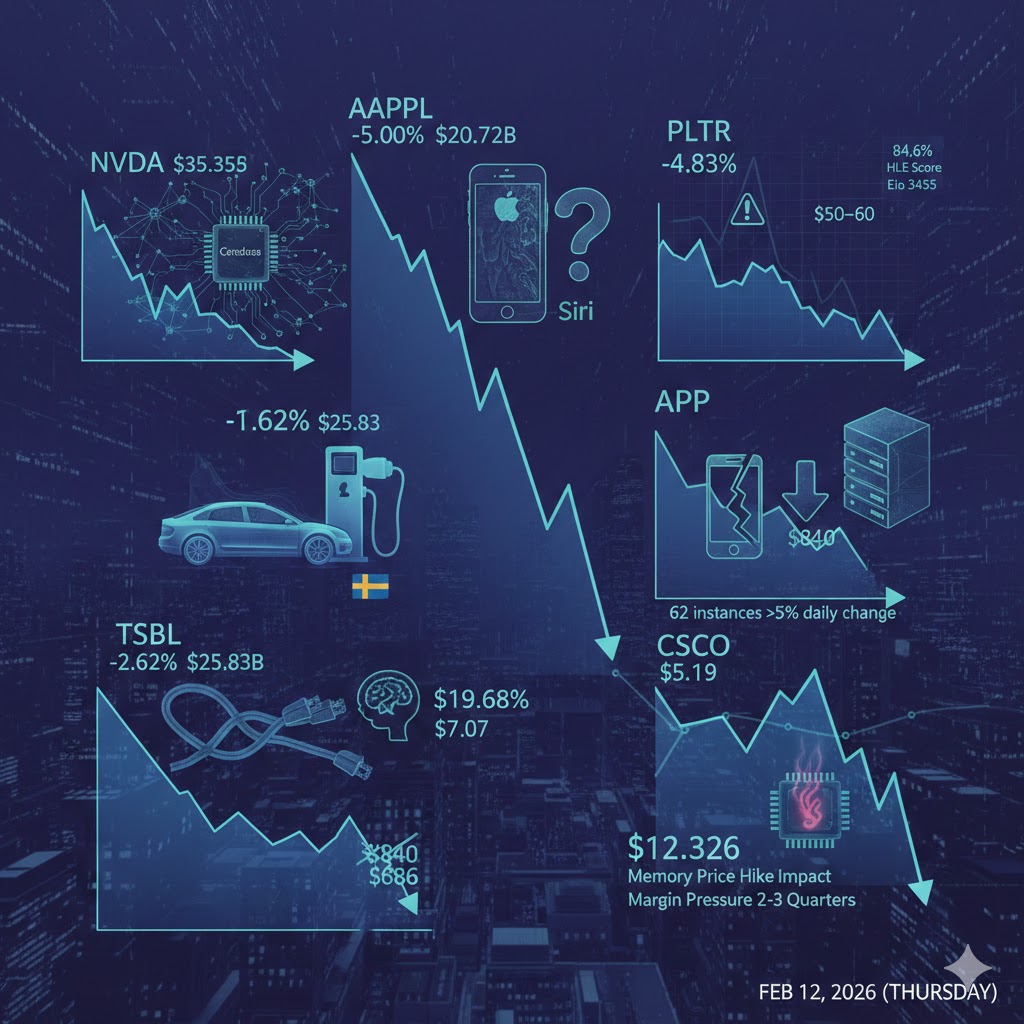

NVIDIA (NASDAQ:NVDA) closed down by 1.64%, with a trading volume of $35.35 billion.

According to reports, OpenAI launched its first AI model powered by the chip of NVIDIA’s competitor, Cerebras.

The report states that OpenAI released its first AI model based on semiconductor startup Cerebras Systems’ chip, called GPT-5.3-Codex-Spark. This model is a lightweight but faster version of its latest code automation software, Codex, designed to compete with companies like Alphabet’s Google and Anthropic in the AI programming assistant market.

Second place:

Tesla (NASDAQ:TSLA) closed down by 2.62%, with a trading volume of $25.83 billion.

According to Teslarati, Tesla’s supercharging stations in Sweden remain offline due to a dispute with the IF Metall union.

The Swedish administrative court rejected Tesla’s appeal to force the connection of its charging stations to the grid, causing the station in Ljungby to remain idle for nearly two years since its construction. The court ruled that the union strike at Tesla’s Swedish stations was a reasonable reason for the delay. The Ljungby supercharging station is one of the first to be refused grid access following a strike initiated by IF Metall in late 2023, involving local electricians from the Seko union.

Third place:

Apple (NASDAQ:AAPL) closed down by 5%, marking its largest single-day drop since early April 2025, with a trading volume of $20.72 billion.

Reports suggest that Apple’s long-awaited upgrade to its Siri virtual assistant has encountered delays.

Tech journalist Mark Gurman reported that Apple’s much-anticipated Siri upgrade faced issues during recent tests, and several expected features might be postponed. Apple originally planned to include these features in the upcoming iOS 26.4 release in March, but now considers rolling them out in future versions, possibly as late as iOS 26.5 in May or iOS 27 in September. This marks the second major delay since the Siri upgrade was announced in 2024.

Additionally, Apple is facing scrutiny over political bias on its news platform. The Chairman of the U.S. Federal Trade Commission, Andrew Ferguson, has urged Tim Cook to investigate potential political bias in Apple’s news operations. Ferguson posted on X, claiming that Apple News systematically prioritizes articles from left-wing media while suppressing conservative-leaning content.

Sixth place:

Google-A (NASDAQ:GOOGL) closed down by 0.63%, with a trading volume of $14.79 billion.

On Thursday, February 12, Google announced an upgrade to Gemini 3 Deep Think, claiming that the new model achieved breakthrough results across several industry benchmarks, including a score of 84.6% on the “Humanity’s Last Exam” (HLE) and ARC-AGI-2 tests, as verified by the ARC Prize Foundation. On the competitive programming platform Codeforces, Gemini 3 Deep Think scored an Elo rating of 3455.

Ninth place:

Palantir (NYSE:PLTR) closed down by 4.83%, with a trading volume of $9.54 billion.

The famous investor Michael Burry issued a warning, predicting that Palantir’s stock would drop by nearly 60%.

Palantir announced that it had received a major authorization from the U.S. Defense Information Systems Agency (DISA). However, Burry expressed caution, suggesting that the stock was facing a significant technical crash, with the next support level at $80, and the “landing zone” potentially falling between $50 and $60.

Twelfth place:

Applovin (NASDAQ:APP) closed down by 19.68%, with a trading volume of $7.07 billion.

The stock has fallen more than 45% this year. UBS analysts downgraded their target price for the company ahead of its Q4 earnings report. The analysts lowered the target price significantly from $840 to $686, while maintaining a “Buy” rating. This adjustment came right before AppLovin’s earnings report, sending a signal to investors that contributed to the sell-off before the official results were published.

Analysts pointed out that AppLovin’s stock has been extremely volatile, with 62 instances in the past year where its daily price change exceeded 5%. This recent drop suggests that the market believes this information is noteworthy but does not significantly alter the business outlook.

Seventeenth place:

Cisco (NASDAQ:CSCO) closed down by 12.32%, with a trading volume of $5.19 billion.

Cisco’s comments about the impact of memory price increases put pressure on tech stocks, with the company’s stock suffering its largest single-day drop since May 19, 2022, falling by 13.7%.

The continued surge in memory prices has hit Cisco hard. The company disclosed that the recent quarter’s memory price hikes had negatively affected its gross margin.

Cisco CEO Chuck Robbins noted during an earnings call that the company had implemented several measures to address the rising prices, including raising prices on certain products and renegotiating contracts with channel partners and customers. Robbins expressed confidence that Cisco would manage these challenges more effectively than its peers.

Mizuho Securities analyst Jordan Klein pointed out that Cisco might face two to three quarters of margin pressure, and its weaker guidance poses “substantial risks” to companies like HPE (NYSE:HPE) and Dell (NYSE:DELL), as well as Arista Networks (NYSE:ANET).