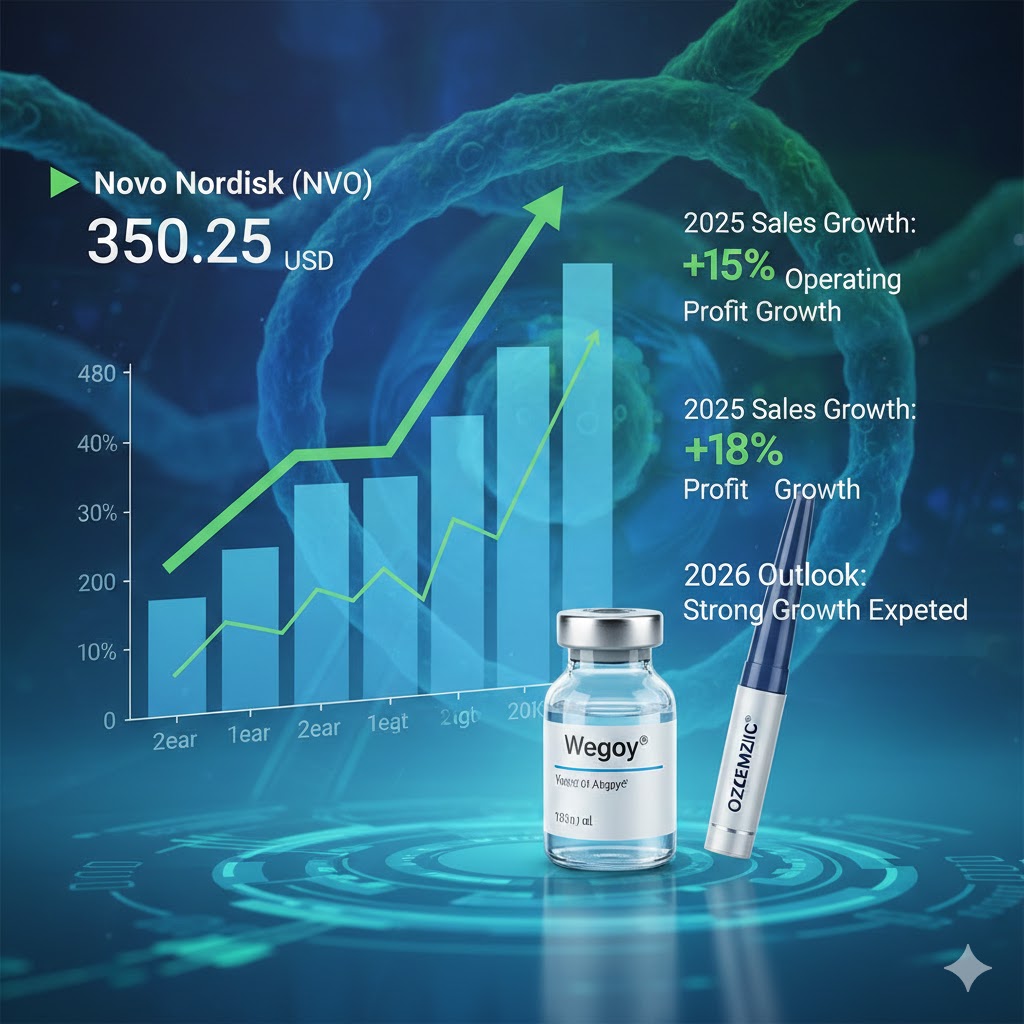

On February 3, Novo Nordisk(NVO) announced its 2025 sales and operating profit growth and released its full-year sales and operating profit outlook for 2026.

In 2025, Novo Nordisk’s sales increased by 10% (at constant exchange rates), reaching DKK 309.1 billion. Operating profit grew by 6%, amounting to DKK 127.7 billion. The previously released sales growth forecast was 8% to 11%, and the operating profit growth forecast was 4% to 7%. The U.S. business experienced a positive impact from gross margin net sales adjustments.

“Although 2025 was a challenging year for Novo Nordisk, we still achieved a 10% sales growth (at constant exchange rates) and benefited nearly 46 million patients with innovative therapies. In 2026, Novo Nordisk will face price challenges in an increasingly competitive market. However, we are highly encouraged by the strong early response to Wegovy® oral in the U.S. and are confident in our ability to drive sales growth in the coming years. We also look forward to the regulatory approval results of next-generation therapies, such as Mim8 for hemophilia treatment and CagriSema for obesity treatment, as well as exciting R&D milestones, including Phase 3 results for etavopivat and ziltivekimab,” said CEO Mike Doustdar.

At the annual shareholders’ meeting on March 26, 2026, the board will propose a final dividend of DKK 7.95 per share for the 2025 fiscal year, bringing the total expected dividend for 2025 to DKK 11.70 per share. The board has also decided to initiate a new share buyback program, with a maximum amount of DKK 15 billion.

2026 Sales and Operating Profit Outlook

Sales and operating profits in 2026 will benefit from a positive impact from a $4.2 billion sales rebate reversal related to the U.S. 340B drug pricing program. Beginning in 2026, Novo Nordisk will adopt new non-IFRS metrics — adjusted sales growth and adjusted operating profit growth — to present its sales and operating profit outlook. This change is aimed at excluding certain special and non-recurring impacts, which are mostly non-cash, including the impact from the $4.2 billion sales rebate reversal in Q1 2026 related to the 340B drug pricing program.

The adjusted sales and operating profit growth figures exclude the positive impact of the 340B sales rebate reversal. In 2025, $400 million was excluded, and in 2026, $4.2 billion will be excluded. The unadjusted sales and operating profit growth forecasts for 2026 (at constant exchange rates) are -1% and 11%, respectively.

This outlook reflects expectations for sales growth in international markets and a decline in U.S. sales. It is expected that the global GLP-1 market will continue to expand in 2026, allowing Novo Nordisk to increase patient coverage and drive sales. However, price reductions, including the impact of the U.S. Most Favored Nation (MFN) agreement and the loss of exclusive rights to semaglutide molecules in some international markets, will offset this growth. Finally, the positive impact from the 2025 U.S. gross margin net sales adjustment will not be repeated.

In international business, the outlook is based on current growth trends, including the continued expansion of GLP-1 therapies and market share growth (primarily in the obesity field), as well as the negative impact of intensified competition and the expiration of semaglutide molecule patents in certain markets. Novo Nordisk will continue to promote Wegovy® in 2026 and expects to launch the 7.2 mg dose in multiple countries.

In the U.S. business, the outlook is based on current prescription trends for injectable GLP-1 products, increasing competition, and negative impacts from reduced coverage for obesity drugs under Medicaid. The outlook also assumes that increased market access investments, as well as the Most Favored Nation agreement with the U.S. government, will allow more Americans to access GLP-1 drugs at lower costs, leading to lower actual prices. Novo Nordisk is also committed to expanding the availability of Wegovy®, particularly in the cash-pay channel, through NovoCare® pharmacies and partnerships with telemedicine providers. The outlook also reflects the situation following the launch of Wegovy® tablets in January 2026, with various related assumptions, such as market penetration, the potential negative impact on injectable obesity drug category growth, and channel mix.

The adjusted operating profit growth forecast is -5% to -13% (at constant exchange rates). The adjusted operating profit growth at DKK is expected to be 5 percentage points lower than the constant exchange rate forecast. The adjusted operating profit outlook primarily reflects the sales outlook, as well as directed investments in current and future growth opportunities in R&D and commercial areas. Some of these investments are funded by the reinvestment of savings from the company’s overall transformation in 2025, as well as further optimization initiatives. In R&D, investments will focus on expanding and advancing both early and late-stage R&D pipelines, mainly in obesity and diabetes, including the impact of acquiring Akero Therapeutics. Commercial investments will focus on the GLP-1 product portfolio in obesity and diabetes.