While market discussions surrounding global streaming giant Netflix (NFLX) currently center on its high-priced bid for fellow streaming player Warner Bros. Discovery (WBD), institutional investors on Wall Street will soon have the opportunity—at least temporarily—to shift their focus following Netflix’s latest financial results, scheduled for release after Tuesday’s closing bell. Investors are keen to see if the strong earnings growth expectations supporting Netflix’s near-$4000 billion market capitalization remain intact.

Wall Street analysts generally believe the streaming giant is poised to demonstrate robust earnings resilience despite macroeconomic uncertainties. The release of Netflix’s report officially kicks off the earnings season for U.S. tech titans. Given the heavy weighting of these giants in the Nasdaq Composite and S&P 500, their actual performance and future guidance are critical for maintaining the indices’ record-breaking trajectories, fueled by expectations of monetary easing and the AI boom.

Latest reports indicate that Netflix has reached a revised all-cash agreement to acquire the film studios and streaming operations of Warner Bros. Discovery, while continuing to battle Paramount Skydance Corp. for control of one of Hollywood’s most iconic film and entertainment powerhouses.

Market Pricing for Netflix to Shift from M&A Speculation to Fundamentals

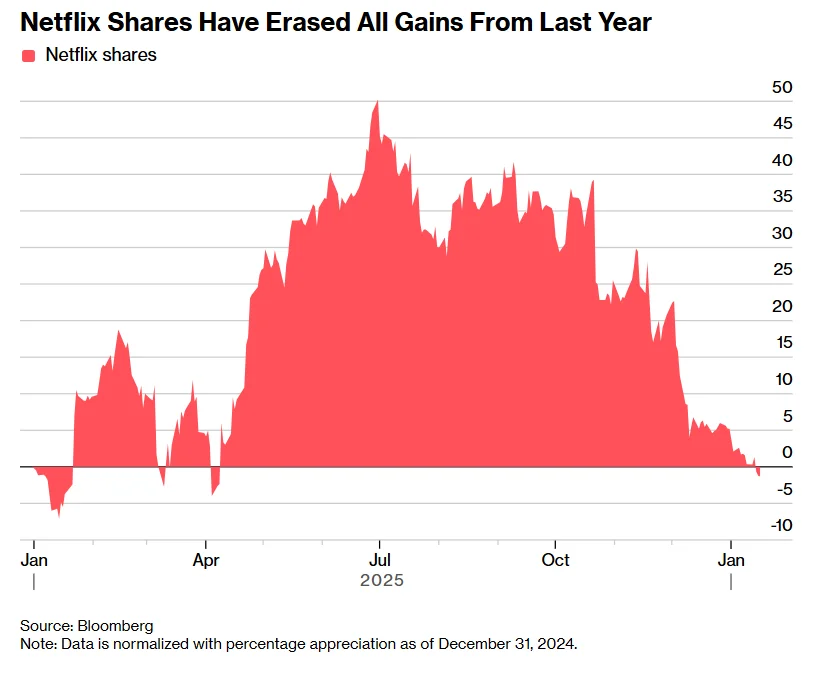

Investors have long harbored concerns regarding the slowdown in Netflix’s subscriber growth and the sustainability of its revenue momentum. These two fundamental issues triggered Netflix’s most severe sell-off in three years following its October 21 earnings outlook. Since then, Netflix’s stock has plunged 29%—a decline exacerbated by fears that an acquisition exceeding $80 billion could lead to massive debt expansion.

At the time, Netflix was viewed as a potential major buyer for Warner Bros. Now, with an $82.7 billion all-cash deal on the table, some investors are growing increasingly uneasy as risks are magnified. However, others view the ongoing sell-off as a significant “buy the dip” opportunity.

“I remain positive on Netflix regardless of whether this mega-deal goes through,” said Eric Clark, Chief Investment Officer at Accuvest Global Advisors, who believes the core logic behind the stock’s decline has been over-interpreted by the market. “I don’t see any scenario that stops the flow of capital into Netflix stock.”

On Tuesday morning, Netflix raised its bid for Warner Bros. to an all-cash transaction, pivoting from a previously agreed-upon mix of cash and stock. In pre-market trading Tuesday, Netflix shares rose 1%, while Warner Bros. shares edged down 0.3%.

According to consensus estimates from Wall Street analysts, the Los Gatos, California-based streaming giant is expected to report fourth-quarter earnings per share (EPS) of 55 cents, representing a 28% year-over-year increase. Revenue is projected at approximately $12 billion, up 17% year-over-year. However, analysts generally expect revenue growth to slow significantly over the next three quarters before picking up again in 2027.

“Is someone joking? There is no way this earnings report distracts investors from the ongoing fundamental struggles at Netflix,” Benchmark Co. analyst Daniel Kurnos wrote in a January 13 report. “But it may remind people of Netflix’s stabilizing fundamentals and its operating leverage in the upcoming golden year of ‘Connected TV’.”

Kurnos, who holds a “Hold” rating on Netflix, expects the company to provide a strong revenue and operating profit outlook for 2026. This could offer bullish investors a brief respite from the current obsession with the acquisition—a “love triangle” he believes will not end soon and is bound to become more chaotic. He also expects accelerated revenue growth in international markets and noted the advertising partnership with Amazon as an optimistic fundamental driver.

“Given Netflix’s incredibly strong content lineup, the company likely achieved a powerful fourth quarter,” Bloomberg Intelligence analyst Geetha Ranganathan wrote last week. She specifically highlighted the final season of Stranger Things, the Jake Paul vs. Anthony Joshua boxing match, and NFL games during the Christmas holiday. However, she added that if revenue misses expectations, “it will exacerbate market concerns about structural growth, especially against the backdrop of the blockbuster deal with Warner.”

As future uncertainty increases, investors will most closely watch the company’s operating margin outlook for the year, according to TD Cowen analyst John Blackledge. He expects net paid subscriber additions of 14.2 million this quarter—down from last year’s 19 million, but higher than the consensus estimate of roughly 11 million.

Meanwhile, the acquisition drama with Warner Bros. continues. Netflix is reportedly revising deal terms to an all-cash agreement to accelerate the process and counter pressure from rival Paramount Skydance Corp.

“Regardless of how the M&A process unfolds, Netflix likely wins in the end,” wrote Kurnos of Benchmark. He is optimistic about the merger, believing it would create a “dominant force in film and streaming, particularly in terms of pricing, user interaction, and engagement.” Conversely, if Netflix fails to acquire Warner Bros., “it might appease investors uninterested in the deal, given the poor track record of media industry mergers,” potentially boosting the stock due to a sudden reduction in debt pressure and cash flow concerns.

However, for some institutional investors, the massive bid for Warner Bros. is too expensive and risky for a company that hasn’t historically grown through major acquisitions and would bring on significant debt.

“I have lost all interest in the earnings,” said Vikram Rai, portfolio manager and macro trader at First New York. Netflix was a long-time favorite of his, but the acquisition plan turned him bearish, leading him to sell his position weeks ago. “If Netflix stock rebounds, I will choose to short it.”

Netflix Modifies Warner Bros. Deal to All-Cash Bid

According to the latest reports, Netflix has reached a revised all-cash agreement to acquire the film and television studios and streaming business of Warner Bros. Discovery. This is part of its ongoing competition with Paramount Skydance to acquire one of Hollywood’s most iconic entertainment entities.

Netflix had previously agreed to acquire Warner assets for $27.75 per share in a mix of cash and stock but will now pay that amount entirely in cash, according to filings confirming the revised terms. Warner Bros. plans to convene a special shareholders’ meeting to approve the deal, with Netflix stating shareholders will have the opportunity to vote by April.

These changes aim to expedite the acquisition and address criticisms from Paramount, which claims its $30 per share cash offer—including cable channels like CNN and TNT—is superior. Paramount Skydance, currently the parent company of CBS and MTV, has been urging Warner shareholders and investors to tender their shares.

This unprecedented battle for Warner Bros. is the largest media industry deal in Hollywood in recent years and could reshape the streaming and entertainment landscape. Paramount has been aggressively pursuing Warner Bros. since last September, while Netflix emerged as a surprise potential buyer after Warner Bros. announced the sale in October.

The new terms eliminate a primary criticism of Netflix’s proposal—that the stock component made the bid less attractive compared to Paramount’s.

The Warner Bros. board “continues to support and unanimously recommend our initiated transaction, which we believe will deliver the best outcome for shareholders, consumers, creators, and the broader global entertainment community,” Netflix Co-CEO Ted Sarandos said in a statement.

Warner Bros. also addressed another point of contention by clarifying how it values its cable networks, which are to be spun off into an independent company named Discovery Global.

Warner Bros. has rejected multiple prior offers from Paramount. The Paramount bidding group has threatened a proxy battle and sued to force Warner Bros. to disclose more information about Netflix’s offer and the value of the cable assets.

Filings reveal that Warner Bros.’ financial advisors estimate the overall value of these cable network businesses at anywhere from $0.72 to $6.86 per share. Paramount claims these assets are worthless, even though cable networks account for the largest share of its own sales and profits.

Under the spin-off plan, Discovery Global would hold $17 billion in debt by June 30, 2026, projected to drop to $16.1 billion by year-end. Netflix and Warner Bros. also modified the agreement to reduce Discovery Global’s debt by approximately $260 million, citing stronger-than-expected cash flow last year. Documents project Discovery Global’s network revenue at $16.9 billion in 2026, with an adjusted EBITDA of $5.4 billion.

For Netflix, Success Means Sitting on a Massive IP Goldmine

If Netflix and Warner Bros. merge, it would combine the world’s two largest streaming providers with a combined subscriber base of approximately 450 million. It would grant Netflix an exceptionally rich IP library to compete against giants like Disney and Amazon. Hollywood unions and theater owners have expressed concern that such a massive acquisition could harm their members’ profits and business growth.

For Netflix’s revenue-dependent streaming platform, acquiring Warner Bros. (including the “non-cable assets” such as Warner Bros. Pictures/TV Studios, HBO, and HBO Max) would signify an upgrade from a “pure streaming platform” to an integrated giant of “leading platform + top-tier studio + massive IP library.” High-value content that previously required external licensing would become self-controlled long-term assets, providing a significant advantage in the “streaming wars.”

With Warner Bros. under its belt, Netflix’s content moat and pricing power would strengthen significantly. It could use classic libraries and long-running series to improve retention while leveraging “mega-IPs” to drive new films, spin-offs, games, and merchandising. Furthermore, it would integrate HBO’s world-renowned “prestige drama” capabilities into Netflix’s global distribution system.

If the deal is finalized, the key global IPs Netflix would control include:

- Fantasy/Super-IPs: The Wizarding World of Harry Potter (including Fantastic Beasts), the DC Universe (Batman, Superman, Wonder Woman, Suicide Squad, etc.), The Matrix series, The Conjuring universe, The Lord of the Rings and The Hobbit series, and the Dune franchise.

- HBO Powerhouses: The Game of Thrones universe (including House of the Dragon and A Knight of the Seven Kingdoms).

Paramount Skydance CEO David Ellison argues that a merger with his company would maintain a more traditional Hollywood structure and preserve Warner Bros.’ heritage. He believes his all-cash proposal has stronger financial advantages and would be easier for regulators to approve. Ellison is launching his own PR offensive, though he has yet to convince the Warner Bros. board or a majority of shareholders. Institutional investors remain divided, with some demanding Paramount continue to raise its bid.