The landscape of South American energy is witnessing a profound recalibration as 2026 begins. Following recent shifts in regional leadership, the United States government is aggressively moving to re-integrate Venezuelan crude into the global marketplace through established corporate channels. At the heart of this strategy is Chevron Corporation (CVX), the sole U.S. oil major that has maintained a continuous, albeit restricted, presence in the country. On Friday, January 16, 2026, U.S. Energy Secretary Chris Wright confirmed that the federal government is moving “as fast as it can” to authorize an expanded production license for the energy giant.

This latest regulatory update is far from a mere administrative formality. According to Secretary Wright, the new licensing framework will permit Chevron to pay the Venezuelan government in cash for its operations, a departure from the “crude-in-kind” debt-settlement model that has defined the relationship for years. This adjustment effectively unlocks the company’s ability to market 100% of its joint-venture production, providing a level of commercial flexibility not seen in decades. For investors and analysts tracking CVX stock, the implications of this policy shift are being weighed against a broader backdrop of commodity price volatility and massive infrastructure requirements.

Chevron (CVX) Stock Market Performance and Financial Health

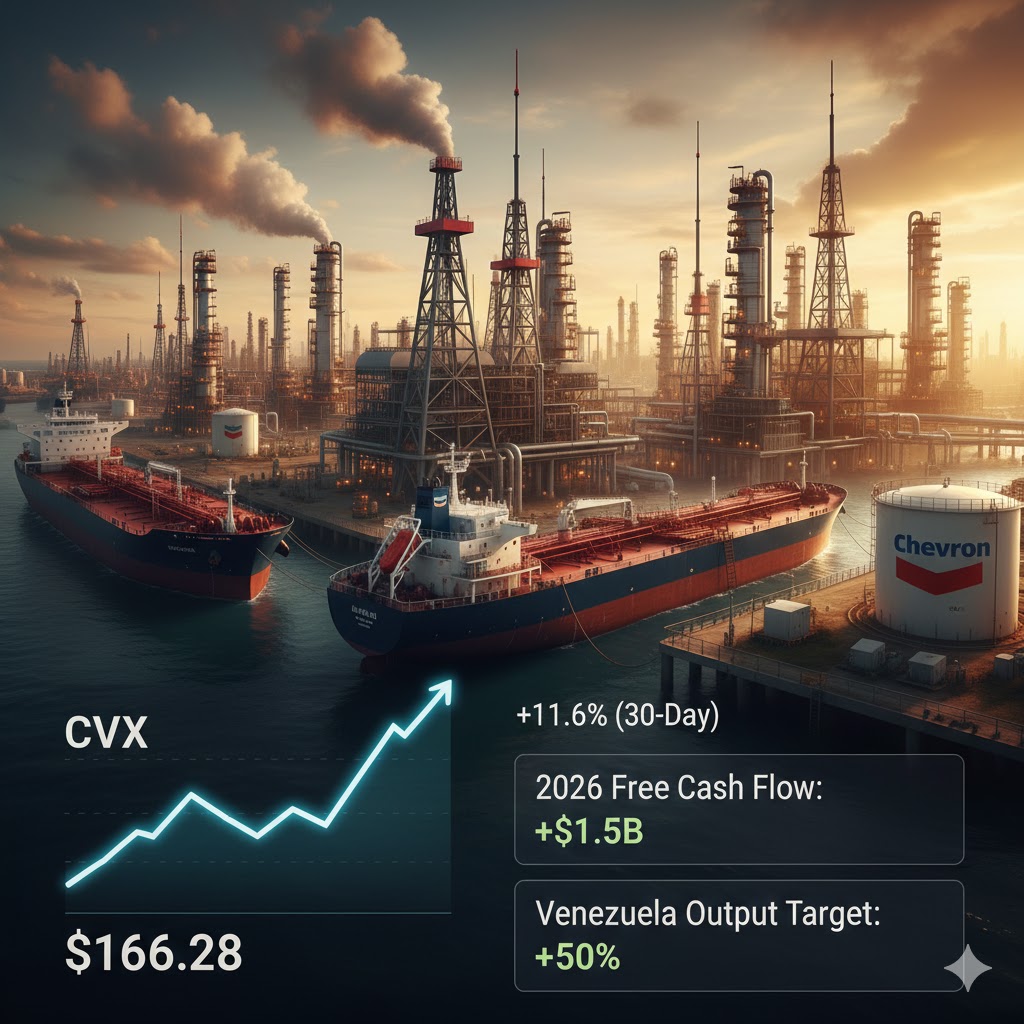

As of the market close on January 16, 2026, the CVX stock price settled at $166.28. While broader market narratives in early January hinted at explosive growth, the actual price action has been one of steady, calculated gains. The CVX stock recently hit a 52-week high of $169.37, representing a solid 11.6% increase over the trailing 30 days. This performance outpaces many of its peers in the energy sector, which saw an average decline of roughly 1.2% during the same period.

| Key Market Data | Chevron (CVX) as of Jan 16, 2026 |

| Current Stock Price | $166.28 |

| 52-Week Range | $132.04 – $169.37 |

| Market Capitalization | $332.41 Billion |

| Forward P/E Ratio | 21.14 |

| Dividend Yield | 4.11% |

| Average Volume | 9 Million Shares |

Financially, Chevron entered 2026 on a stable foundation, though not without headwinds. The company’s 2025 earnings estimate is pegged at approximately $7.34 per share, a figure that reflects the reality of lower average crude prices compared to the previous year. However, its cash flow remains a pillar of strength. Chevron reported a significant free cash flow expansion of approximately $12.5 billion projected for the full year 2026, driven largely by its leaner operating model and the ramp-up of the Tengiz Future Growth Project in Kazakhstan. The company’s net debt ratio remains low at 8.8%, providing the “dry powder” necessary to fund the anticipated rehabilitation of Venezuelan assets.

The Venezuelan License: From Debt Recovery to Cash Expansion

The transition from a “debt-settlement” model to a “cash-payment” model is the most significant development in the U.S.-Venezuela energy relationship. Under the previous General License 41, Chevron was essentially acting as a debt collector, exporting oil to the U.S. Gulf Coast primarily to satisfy billions in unpaid debts owed by PDVSA (Petróleos de Venezuela, S.A.). Under this regime, the CVX stock price was often insulated from Venezuelan growth because the revenue wasn’t “new” cash; it was the recovery of old assets.

The proposed new license changes the calculus entirely. Secretary Wright’s comments suggest that Chevron will now function as a standard commercial operator. By allowing cash payments for royalties and taxes, Chevron can now justify aggressive capital allocation to its four main joint ventures: Petropiar, Petroboscan, Petroindependencia, and Petroindependiente. This “commercial flexibility” allows the company to sell its crude not just to its own refineries in Mississippi and Texas, but to any global third-party buyer willing to pay market rates.

Analysts at UBS and Wells Fargo have noted that this move could catalyze a production surge. Chevron currently accounts for roughly 200,000 barrels per day (bpd) of Venezuela’s output. Secretary Wright explicitly stated that the company sees a pathway to increase this production by 50% over the next 18 to 24 months. If successful, this would add 100,000 bpd of high-margin heavy crude to Chevron’s upstream portfolio, a volume that would be material to its bottom line.

Infrastructure Realities and the 2026 Capital Budget

While the policy tailwinds are strong, the operational reality on the ground in Venezuela presents a steep climb. Decades of underinvestment have left the local power grid and pipeline networks in a state of severe disrepair. In its 2026 capital expenditure budget, Chevron outlined a total organic spend of $18 billion to $19 billion. More than half of this is dedicated to U.S. upstream projects, specifically in the Permian Basin, where production recently topped 1 million barrels of oil equivalent per day.

However, the “Affiliate Capex” segment—which includes joint ventures like those in Venezuela and Tengiz—is slated for $1.3 billion to $1.7 billion in 2026. A significant portion of any “extra things” Chevron does in Venezuela, as Wright put it, will likely be funneled through these affiliate channels. The company is focusing on “highest-return opportunities,” and the low lifting costs of Venezuelan heavy oil make it an attractive target for capital, provided the political and regulatory environment remains “fantastic,” a term Wright used to describe the current level of interaction between Washington and Caracas.

Beyond the upstream sector, Chevron’s downstream business is also a strategic beneficiary. Its refineries on the U.S. Gulf Coast are specifically designed to process the heavy, high-sulfur crude that Venezuela produces. Increased supply from Chevron’s own Venezuelan ventures could lower feedstock costs for its refining segment, improving “cracking margins” and contributing to the company’s goal of $3 billion to $4 billion in structural cost reductions by the end of 2026.

Geopolitical Risk and Competitive Landscape

While Chevron stock has been the primary beneficiary of these developments, the broader sector is watching closely. Following the capture of former leader Nicolás Maduro in early January 2026, market optimism has spread to other players. Exxon Mobil (XOM) and ConocoPhillips (COP) have also seen moderate gains as investors speculate on a broader opening of the Venezuelan energy sector.

Even so, Chevron remains in “pole position.” Unlike Exxon or Conoco, who have spent years in legal battles over expropriated assets, Chevron never left. This “first-mover” advantage means Chevron has the staff, the local partnerships, and the existing infrastructure already in place to ramp up production “quickly,” as Wright expects.

The administration’s strategy of maintaining “indefinite control” over Venezuelan oil revenues through U.S.-overseen trustees adds a layer of security for American firms. This “conditional licensing” model allows the U.S. to ensure that oil proceeds fund American goods and humanitarian needs in Venezuela, rather than being diverted. For the CVX stock surged sharply narrative to maintain momentum, the market will need to see these “permissions and approvals” translate into actual barrels in the coming quarters.

Conclusion: A Strategic High-Wire Act

As we move deeper into 2026, Chevron (CVX) stock represents a unique hybrid of traditional U.S. shale dominance and high-stakes international expansion. The transition of the Venezuelan license to a cash-based commercial arrangement is a watershed moment that significantly enhances the company’s “commercial flexibility.”

For investors monitoring the CVX stock price, the focus will shift from the halls of Washington to the oil fields of the Orinoco Belt. The company’s ability to navigate the physical decay of the Venezuelan oil industry while maintaining its strict capital discipline will be the ultimate test of its 2026 growth strategy. While the stock has not seen a “sudden” vertical spike comparable to a tech startup, its steady ascent and outperformance of the energy sector suggest that the market is beginning to price in a long-term, high-margin recovery of South American production.

The story of Chevron in 2026 is no longer just about recovering old debts; it is about reclaiming a leading role in the global heavy crude market, backed by a favorable U.S. energy policy and a resilient financial profile.