On Tuesday, Pfizer (NYSE:PFE) announced its fourth-quarter earnings. Despite a continued decline in demand for COVID-related products, the company reported revenues and profits that surpassed market expectations. The company also reiterated its cautious guidance for 2026— a forecast that had raised investor concerns when it was released in December last year. Additionally, Pfizer disclosed initial data on its new weight loss therapy, though the information provided was limited.

According to the earnings report, Pfizer’s Q4 revenue stood at $17.56 billion, a slight decline of about 1% year-over-year. The drop in revenue was primarily attributed to the lower demand for its COVID-19 vaccine and the Paxlovid oral antiviral: COVID-19 vaccine sales reached $2.3 billion, exceeding expectations of $2 billion, but still representing a one-third decline compared to last year; Paxlovid sales were only $218 million, far below the expected $589 million, plummeting more than two-thirds from the previous year.

However, the total revenue exceeded the market expectations of $16.95 billion, driven by the strong performance of several of Pfizer’s blockbuster drugs, which met forecasts. Despite competition from Merck’s (NYSE:MRK) new products, its pneumonia vaccine, Prevnar, still achieved $1.7 billion in sales, slightly surpassing the $1.6 billion expectation. The blood-thinning drug Eliquis generated $2 billion in sales, and the heart disease drug Vyndaqel achieved $1.7 billion in sales, both in line with market projections.

During the quarter, Pfizer recorded a net loss of $1.65 billion, or a loss of $0.29 per share, compared to a net profit of $410 million, or earnings of $0.07 per share, in the same period last year. Excluding restructuring charges and costs related to intangible assets, the company’s adjusted earnings per share for Q4 were $0.66, beating the market consensus of $0.57.

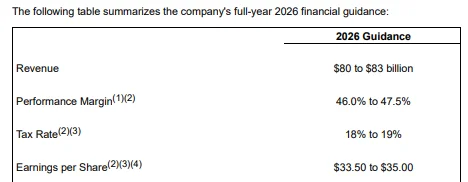

Looking ahead, Pfizer maintained its 2026 earnings guidance, with adjusted earnings per share expected to be between $2.80 and $3.00, and revenue projected to range from $59.5 billion to $62.5 billion, largely flat compared to 2025.

The company previously indicated that the 2026 revenue outlook remains subdued, partly due to the continued decline in sales of its COVID vaccine and Paxlovid. It is expected that these two products will contribute about $1.5 billion less in revenue for the year, totaling $5 billion.

In addition to COVID products, Pfizer also faces revenue losses from drugs losing market exclusivity, which is expected to further reduce the company’s revenue by approximately $1.5 billion. Several products, including Prevnar, are facing increasingly fierce market competition.

Pfizer’s CFO, Dave Denton, told investors in December that the 2026 guidance had fully accounted for the impact of price compression and narrowing margins. As part of a landmark drug pricing agreement with former U.S. President Trump, Pfizer plans to offer larger discounts in the Medicaid business.

Under this agreement, Pfizer will supply existing drugs to Medicaid patients at the lowest prices seen in other developed countries, while also offering the same “most favored nation” drug prices to Medicare, Medicaid, and commercial insurers. In exchange, Pfizer will receive a three-year tariff exemption.

In January, Pfizer’s rheumatoid arthritis drugs Xeljanz and Xeljanz XR were included in the third round of Medicare drug price negotiations, with new prices set to take effect in 2028.

Can the New Weight Loss Drug Fill the Revenue Gap?

To offset the decline in COVID product sales and the shrinking revenue from older drugs, the pharmaceutical giant is looking to long-term investments in its pipeline products, including the $10 billion acquisition of obesity biotech company Metsera. In the earnings release, Pfizer also disclosed Phase 2 clinical data for a Metsera obesity injection, which is administered monthly and shows significant weight loss effects for patients. This has generated optimism about the potential value of the acquisition.

However, despite the positive data, Pfizer’s stock fell by more than 5% in pre-market trading following the earnings report. Investors remain cautious, as the clinical trial details were sparse. There are doubts about whether the high-priced acquisition of Metsera will be able to fill the revenue gap created by the declining sales of the COVID vaccine and oral antiviral products.

The clinical data showed that after 28 weeks of treatment, participants lost up to 12.3% of their body weight compared to a placebo group. Analysts have pointed out that more detailed information is needed to accurately assess where this drug fits in the rapidly evolving market dominated by Novo Nordisk (NYSE:NVO) and Eli Lilly (NYSE:LLY).

Mizuho Healthcare Analyst Jared Holz stated, “The current market is firmly controlled by two well-established companies.” He believes that Pfizer needs a product that significantly outperforms existing ones in terms of efficacy or safety in order to establish a foothold in this field.