As the U.S. earnings season gathers pace, corporate executives are issuing a collective warning about the consumer outlook. Despite economic data showing steady growth, CEOs across sectors—from aviation and consumer goods to industrial fields—report that geopolitical tensions and policy uncertainties are making consumers cautious and corporate planning increasingly difficult.

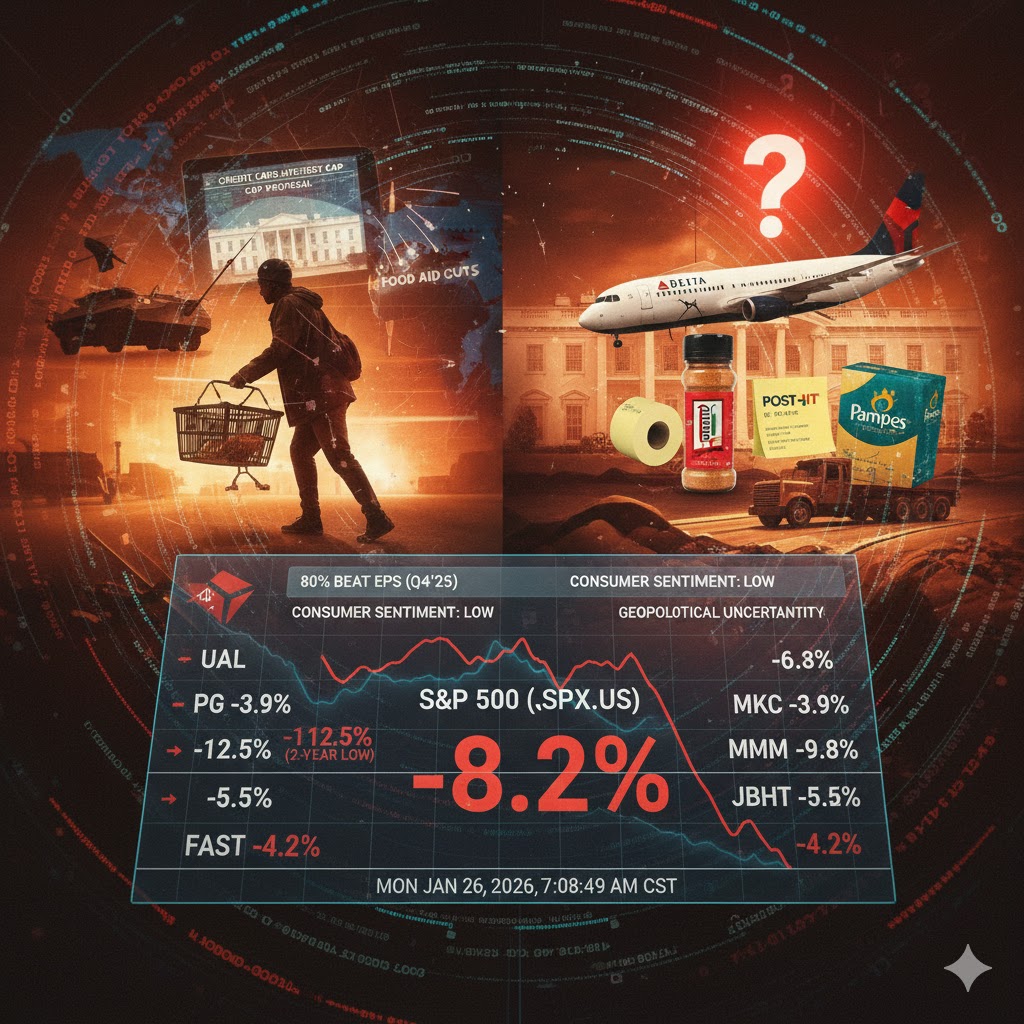

Several industry leaders released cautionary signals in their latest reports. Delta Air Lines (DAL) maintained a guarded stance on profits amid geopolitical instability, while United Airlines (UAL) warned that global tensions could dampen travel demand. Executives at Procter & Gamble (PG) and McCormick (MKC) noted that consumers are remaining prudent. 3M (MMM) saw its sharpest decline since April after its outlook fell short of expectations, citing an uncertain macro environment for its consumer and automotive businesses. Similarly, results from industrial distributor Fastenal (FAST) and logistics firm J.B. Hunt (JBHT) left investors disappointed.

These pessimistic notes contrast with many key economic indicators. Data from last year showed steady growth and resilient consumer spending. According to Bloomberg Intelligence, as of Thursday’s close, 80% of S&P 500 companies that have reported results exceeded analyst expectations.

Corporations are reporting at a rare intersection of political upheaval and global uncertainty. With the S&P 500 Index (.SPX) posting double-digit gains for three consecutive years, stock valuations are high, leaving little room for error. Executives now face the difficult task of setting the tone for the coming year as President Trump continues to reshape U.S. trade relations and international policy.

Corporate America Warns of Early-Year Growth Pressure

United Airlines noted that U.S. military actions in Venezuela have had a “measurable negative impact” on Caribbean bookings. CEO Scott Kirby warned that geopolitical risks could disrupt what otherwise appeared to be a strong start to the year.

The Chicago-based carrier also pointed to a larger-than-expected blow from President Trump’s proposed credit card interest rate cap. This reflects the deep ties between airlines and the payment industry through lucrative co-branded card partnerships—a proposal that caused financial stocks to tumble earlier in the earnings season.

Meanwhile, consumer goods giants are feeling the squeeze. McCormick (MKC) CEO Brendan Foley stated during a Thursday call: “The environment in our key markets is characterized by volatility and continues to face pressures from inflation, geopolitical and trade uncertainties, and the risk of rising unemployment. Overall consumer confidence remains low.” The spice and condiment maker saw its shares suffer their biggest drop in two years as both Q4 results and full-year guidance missed targets.

Procter & Gamble, the maker of Pampers and Tide, noted similar disruptions despite forecasting sales growth for the next six months. Both P&G (PG) and McCormick cited the temporary halt of food assistance programs (SNAP) due to the government shutdown as a blow to low-income consumers, which in turn impacted sales.

Industrial firms noted lingering demand headwinds. The CFO of Fastenal remarked that the U.S. economy “continues to send mixed signals, particularly in the industrial sector.” At J.B. Hunt, executives said the freight market remained unstable at the start of the year—even as immigration policy restricted labor supply, a dynamic that usually supports higher shipping rates.

3M ($MMM.US) saw its stock price hit the largest drop since April after releasing a lower-than-expected outlook. The manufacturer of Post-it notes, roofing granules, and electronic materials stated that the macro environment for its consumer and automotive businesses remains uncertain.

Policy Uncertainty Dominates Corporate Planning

Steve Sosnick, Chief Strategist at Interactive Brokers (IBKR), said policy uncertainty is “absolutely” overshadowing positive corporate news:

“It really makes it harder for management to plan… but what CEO is going to say, ‘White House policy instability is making it hard for me to run my business’?”

Corporations are releasing results at a rare junction of political turmoil and global uncertainty. The challenge for CEOs is how to define the company’s future outlook against the backdrop of Trump’s continuous reshaping of trade relations and international policies.

Meanwhile, parts of the Trump policy agenda could provide near-term relief for consumers. Investors are betting that excess tax refunds and potential stimulus measures might help bolster spending for low-income households, at least temporarily. The White House has placed affordability at the core of its messaging, from credit card interest initiatives to efforts to force tech companies to bear rising electricity costs.

Eric Clark, Chief Investment Officer at Accuvest Global Advisors, noted:

“This is a mid-term election year, so the rhetoric has started. Who knows if it actually helps the consumer? But it might make them feel like help is on the way, which ultimately helps boost sentiment.”