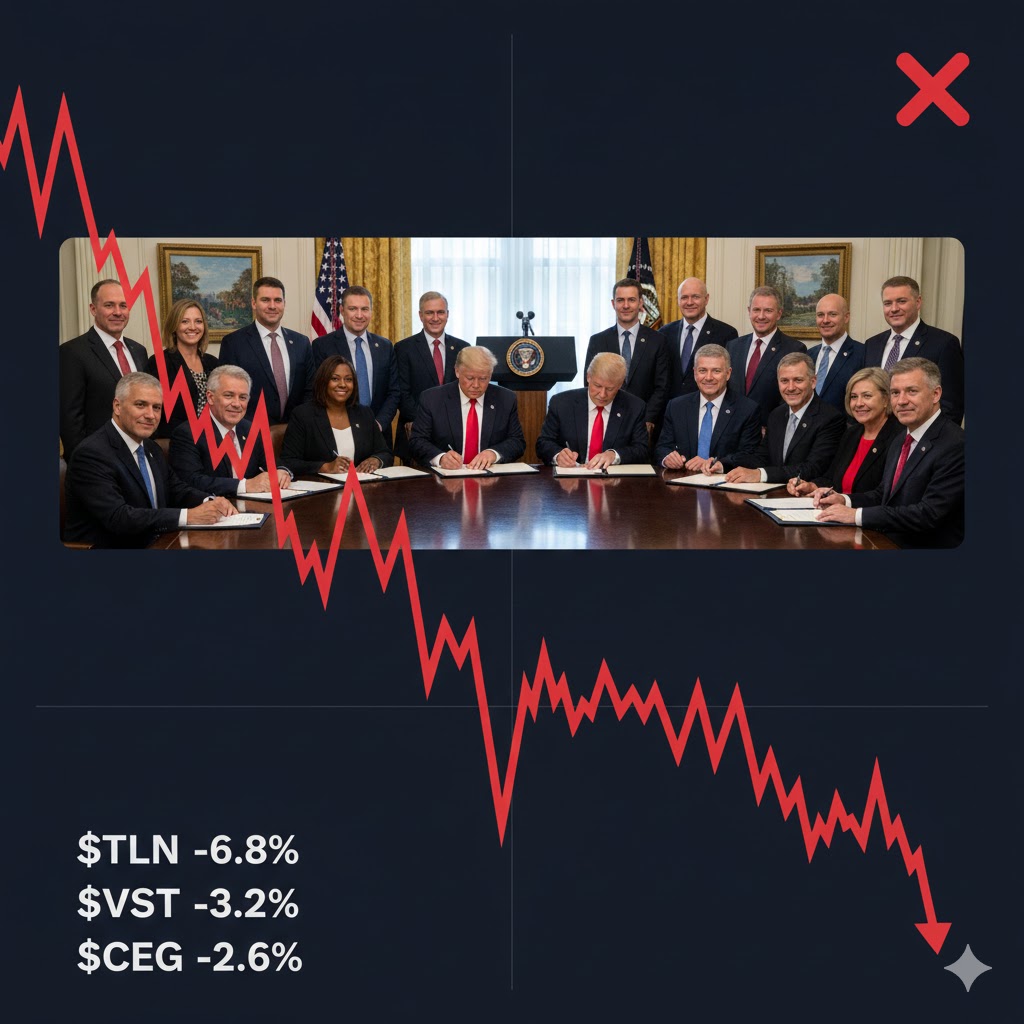

On January 16, 2026, financial markets responded sharply to news that the Trump administration and governors from 13 U.S. states are signing an agreement at the White House designed to curb rapidly rising electricity costs largely driven by surging data center demand. This coordinated policy initiative — centered on imposing new price limits on future capacity auctions in the PJM Interconnection grid and shifting more grid expansion costs to big technology companies such as Amazon and Google — has sent ripples through the utility sector, notably contributing to early-session declines in major independent power producers’ stocks.

The reaction was immediate: in pre-market trading, Talen Energy (TLN) stock dropped about 6.8 %, Vistra Corp (VST) stock declined around 3.2 %, and Constellation Energy (CEG) stock slid roughly 2.6 % as investors weighed the implications of an unprecedented government push to re-engineer wholesale electricity market incentives.

The Agreement: What It Is — and What It Is Not

According to multiple sources, governors from states with rapid data center build-outs — including Pennsylvania, Ohio, Virginia, and Maryland — will sign a statement of principles with the Trump administration that reflects shared goals to “curb rising electricity costs” by reforming market mechanisms affecting the PJM Interconnection, a regional grid serving more than 67 million people from the Mid-Atlantic into the Midwest.

Key elements reportedly include:

- A two-year price cap on future PJM capacity auctions, intended to limit extraordinary spikes in wholesale electricity costs that have fed into retail bills and political controversy.

- Shifting a greater share of grid expansion and reliability costs to large data center operators, particularly Big Tech companies whose rapid expansion is seen as a major driver of PJM price increases.

- Discussions about an emergency auction for long-term (15-year) power contracts to underwrite new generation capacity with tech sector participation — a significant departure from PJM’s traditional 12-month forward capacity market.

Critically, this agreement is not formal federal legislation nor a PJM-issued rule change on its own: it appears to be a high-level policy “principles statement” backed by the National Energy Dominance Council and supportive governors. That political pressure — not legal mandate — is in many ways the engine behind the market reaction.

Why It Matters: Market Dynamics and Price Signals

Under the current PJM structure, auction results for generation capacity serve as important price signals to incentive construction of new facilities and ensure supply meets demand years in advance. Historically, when capacity is scarce relative to projected load, auction prices rise — rewarding available and new capacity and sending clear market signals for investment.

But capacity prices in recent cycles have soared to historically high levels, prompting fierce debate over affordability and whether certain load growth — most visibly from data centers bringing large power loads into the grid — should bear a heavier cost burden.

The proposed price cap and cost-shifting mechanisms are intended to:

- soften short-term volatility in capacity costs and protect residential ratepayers, and

- make data centers contribute directly to the cost of grid expansion their demand necessitates.

However, regulatory economists and grid stakeholders have long warned that artificially capping prices without ensuring adequate supply growth can weaken investment signals, potentially leading to future reliability concerns if generators conclude that returns will be constrained relative to project risk.

The mechanics of whether PJM will accept or implement the policy package remain uncertain: PJM publicly noted it will not attend the White House announcement, underscoring the complex interplay between political advocacy and operational independence.

Sector Reaction: TLN, VST, CEG Stock Responses

Talen Energy (TLN): A Capacity-Sensitive Play

Talen Energy (TLN ) — a generation-heavy independent power producer whose revenue streams hinge heavily on capacity auction outcomes and ancillary services — was among the most negatively affected by the news.

Talen’s portfolio includes fossil fuel-fired plants, some carbon-free (e.g., nuclear interests), and peaking capacity — assets that are particularly sensitive to auction price outcomes. When capacity prices spike, Talen’s near-term revenue improves; when price signals are dampened by intervention or cap policies, near-term contract value and future earnings visibility can be pressured.

Financially, Talen’s recent reported figures indicate that capacity revenues form a meaningful portion of total cash flows, with past auctions accounting for significant receipts that supported capital commitments and cash flow forecasts. A 6.8 % pre-market drop in TLN stock price reflects market nervousness about potential constraints on future capacity pricing.

Talen’s broader growth strategy has included acquisitions and conversion of legacy assets to more flexible generation — aimed at capturing diverse revenue streams beyond pure spot pricing — but a policy regime perceived as reducing future pricing flexibility can compress expected returns on those investments.

Vistra (VST): Diversification Tempers But Does Not Eliminate Risk

Vistra (VST) declined less sharply than Talen, reflecting its diversified portfolio across natural gas, nuclear, solar, and storage assets spanning multiple U.S. market regions.

Vistra recently made strategic moves to expand its gas-fired generation footprint through a multi-billion-dollar acquisition, support integration of battery storage, and broaden its retail supply operations. These initiatives reduce reliance on any single revenue stream — but capacity market revenues remain an important earnings driver in PJM and other markets.

The 3.2 % pre-market drop in VST stock price signals investor concern about potential dampening of capacity price volatility, particularly in markets where capacity auction outcomes inform dispatch economics and project financing returns.

Vistra’s management has guided toward higher core earnings over 2026 driven by demand growth, but the evolving policy environment requires reassessment of revenue assumptions in capacity price models and stress testing under potential price cap regimes.

Constellation (CEG): Nuclear and Retail Contracts in a Policy Squeeze

Constellation Energy (CEG), which includes significant nuclear generation and long-term power purchase agreements with technology customers, also saw a near 2.6 % drop before the bell.

Constellation’s financials reflect robust earnings from long-term contracts and diversification into retail supply and clean energy services — lessening reliance on short-term auction dynamics relative to peers. Nuclear’s baseload nature helps provide stable operating revenue, and Constellation has inked multi-year supply agreements with major data consumers.

Yet, even here, intervention in wholesale pricing signals — especially if linked to cost shifting that alters the value of future capacity receipts — introduces uncertainty into forecasting models used by analysts and project planners. The stock’s modest drop relative to peers reflects Constellation’s more resilient revenue base, even as policy news injects caution into growth narratives.

Can the Plan Curb Electricity Prices?

Assessing whether the agreement will meaningfully and sustainably reduce electricity prices requires disentangling several factors:

- The policy’s legal and operational force:

The initiative, as described, is a statement of principles unlikely on its own to override PJM’s independent governance, although bipartisan political pressure could influence future rule changes. - Price caps vs. supply growth incentives:

Caps on capacity prices can provide short-term consumer relief but can also reduce incentives for generators to build in areas where returns are constrained, potentially worsening supply tightness decades out unless accompanied by robust, credible investment frameworks. - Shifting costs to data centers:

Making large load customers bear more grid expansion costs may spread burden differently, but if the underlying capacity deficit relative to demand growth remains acute, average prices may still rise or remain elevated. - Broader demand trends:

Expanding data center electricity demand — intertwined with AI growth — continues to push load forecasts upward. National Energy Assistance Directors Association data show average retail electricity prices rose significantly in 2025, with peak rates near record highs — illustrating the tension policymakers are trying to address.

In sum, the policy’s efficacy depends more on how PJM and regional stakeholders implement or counter-respond to political signals than on the initial signing itself.

Long-Term Implications for Utilities

Beyond immediate price reactions, the broader utilities sector faces a convergence of structural trends:

- Demand growth from AI and data infrastructures that place sustained upward pressure on grid capacity planning.

- Renewable and storage integration challenges, where balancing intermittent supply with reliable dispatch is economically and operationally complex.

- Regulatory churn as federal and state authorities grapple with affordability and reliability trade-offs.

For independent power producers like Talen and Vistra, capital expenditure plans and project valuations increasingly incorporate not just load forecasts but policy risk scenarios around auction design and price signal evolution.

For Constellation and similar firms with stable long-term contracts and diversified assets, the impact of policy uncertainty may be less immediate but still material to strategic planning as markets transform.

Conclusion

The announcement that governors from 13 states and the Trump administration will sign an agreement aimed at curbing rising electricity costs — enforcing two-year price caps on future PJM capacity auctions and redistributing grid expansion costs — has sent TLN stock, VST stock, and CEG stock lower in pre-market trading, reflecting broader investor caution about regulatory risk.

Whether the policy ultimately succeeds in curbing consumer price growth without unintended consequences — such as blunting investment incentives or distorting capacity market signals — remains largely dependent on implementation by PJM and the depth of political pressure exerted on independent grid governance. For utility companies, the episode underscores an evolving investment landscape where political, economic, and technological forces intersect in defining how America’s power infrastructure evolves alongside the insatiable demand of next-generation digital economies.